Stock Options

Optimizing returns and reducing risk regardless of market conditions

We support clients with comprehensive online stock options trading services augmented by real-time quote information. Our seasoned options experts hold monthly workshops and seminars designed to explain how investors can use various option strategies to generate better returns and minimize risks while sharing their insights about trading option

Types of Stock Options

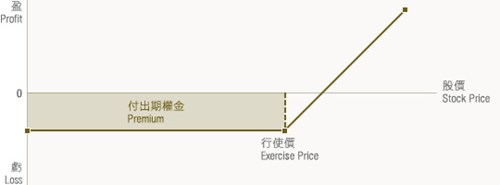

Call Options

Long Call: Bullish investors have the right to buy the underlying shares at an exercise price any time prior to the expiry date.

Profit: When the price of the underlying stock rises, attractive profit-making opportunities can be found.

Loss: When the price of the underlying stock falls, the loss is limited to the option price itself.

Long Put: Bearish investors have the right to sell the underlying shares at an exercise price any time prior to the expiry date.

Profit: When the price of the underlying stock falls, attractive profit-making opportunities can be found.

Loss: When the price of the underlying stock rises, the loss is limited to the option price itself.

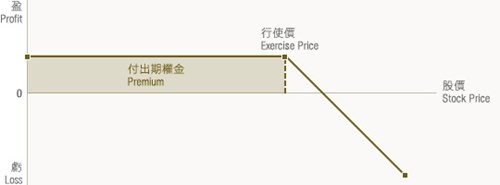

Put Options

Short Call: Bearish investors have the right to sell the underlying shares at an exercise price any time prior to the expiry date.

Profit: When the price of the underlying stock falls, attractive profit-making opportunities can be found.

Loss: When the price of the underlying stock rises, the loss is limited to the option price itself.

Short Put: In the event that investors are somewhat but not overly bearish on the underlying stock, when the option is exercised, the stock should be bought at the exercise price.

Profit: Once a profit is made when the price of the underlying stock rises, the profit is limited to the option price itself.

Loss: Once a loss is incurred when the price of the underlying stock falls, the potential loss can be significant

Stock Options Contract

The List of Stock Option Classes available for trading

For the list of Stock Option Classes, please refer to HKEx website.

Contract Summary

| Items | Specification |

|---|---|

| Option Types | Puts and Calls |

| Contract Size | One board lot of the underlying shares (Except for some contract) |

| Contracted Value | Contracted Value Option Premium X Contract Size |

| Contract Months | Spot, the next two calendar months & the next two quarter months (HKEx may introduce any other longer-dated expiry month in selected stock option classes as it deems necessary) |

| Minimum Fluctuation | HK$0.01 |

| Option Premium | Quoted in HK$0.01 |

| Trading Hours | 09:30 – 12:00 & 13:00 – 16:00 |

| Expiry Day | Business day immediately preceding the last business day of the contract month |

| Exercise Style (American Style) | Options can be exercised at any time up to 18:45 on any business day and including the last trading day (Note: Client should notify the exercise instruction before 17:00 on the trading day ) |

| Exercise Fee | HK$2 |

| Settlement | Physical delivery of underlying shares on exercise and settlement period are: T+1 (Option premium, payable in full) or T+2 (Stock transfer following exercise) |

| Trading Tariff | Tier 1 Stock Options - HK$3 per contract per side Tier 2 Stock Options - HK$1 per contract per side Tier 3 Stock Options - HK$0.5 per contract per side Commission is negotiable |

Option Contract Month Code

| JAN | FEB | MAR | APR | MAY | JUN | JUL月 | AUG | SEP | OCT | NOV | DEC | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Call | A | B | C | D | E | F | G | H | I | K | K | L |

| Put | M | N | O | P | Q | R | S | T | U | V | W | X |